On July 31, 2025, the U.S. Treasury executed a subtle yet strategic buyback operation, repurchasing $2 billion in long-dated government bonds maturing between 2036 and 2045. Out of $19.7 billion offered by Wall Street dealers across 29 eligible issues, only two bonds were selected through a reverse auction, prioritizing the deepest discounts.

These bonds, issued during low-interest eras, now trade at steep markdowns due to rising rates—purchased at $72.15 and $82.02 per $100 face value. This illiquidity stems from their “off-the-run” status, making them hard to sell without disrupting markets.

The move isn’t about immediate savings; funding likely came from cash reserves or short-term T-bills yielding ~5%, potentially raising short-term costs. Instead, it’s risk mitigation: reducing “duration” sensitivity in the system amid inflation, trade tensions, and declining foreign demand from holders like China and Japan. With the Fed shrinking its portfolio via quantitative tightening, the Treasury fills the gap, preventing yield spikes that could hike mortgages, hurt pensions, and slow investments.

Effectively a “stealth” yield curve control, this operation anchors long-term rates without overt intervention, saving $370 million in future repayments.

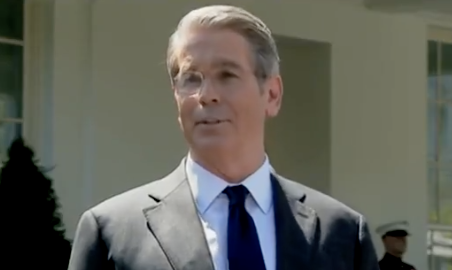

The Treasury plans to double buybacks to four per quarter, signaling a recurring tool to manage debt and liquidity. This subtle intervention, offering a $370 million discount on future liabilities, reassures Wall Street of controlled support without a full rescue. Leading this slick business is Treasury Secretary Scott Bessent, whose expertise in navigating complex financial trades is obvious in this savvy policy shift.

🚨 The U.S. quietly bought back $2B in its own long-dated debt.

— StockMarket.News (@_Investinq) August 1, 2025

Most missed it.

But this may be the most clever and under-appreciated policy move of the year.

(Save this thread) pic.twitter.com/2sbkZjXE3O